Oil well drilling cost per foot is a convenient way of comparing the economic impact of bit performances (Roller cone bit performance – PDC bit performance) on a well that is to be drilled. We are not interested in the absolute, actual, real, or true cost per foot on a real well. Bit prices, rig rates, and other drilling costs may well be different for the planned well, and it is the planned well that we are interested in. We use cost per foot to compare drilling bit performances to aid bit selection, not to provide a historical record of costs. We wish to predict the future, not analyze the past.

The Cost per Foot Equation For Drilling Oil & Gas Well

Here is the Cost per Foot equation. [we can express this measure in currency units and depth units.]

Cost per Foot = (Bit Cost + Rig Cost x (Drill Time + Trip Time)) / Interval

It is simple in concept. The cost of drilling an interval is governed by :

- Firstly, the cost of the bit with which we drill the interval;

- Secondly, the time it takes to drill the interval;

- Thirdly, the cost (the operating cost of the rig) over the time it takes to trip the bit into the hole, to start drilling, and out of the hole once drilling is complete.

If we divide that total cost by the interval drilled, we have the cost per foot.

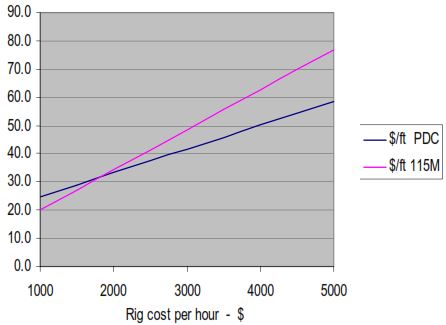

Effects of Rig Rate

Consider what happens if the rig cost is lower. We reach around $1,800 per hour, where the expensive option is. This is a simple but vital point: good economic bit selection can be changed by changing the rig or the rig operating cost.

Limitations For Oil Well Cost Per Foot Formula

The oil well drilling cost per foot approach does have limitations that we should recognize if we are to make productive use of the concept.

The equation may appear simple and the inputs straightforward, but this is misleading. There is much scope for error and uncertainty with the input data. Secondly, we are looking at historical data. We do not know how the bit or bits will perform on the planned well.

Uncertainties in Inputs

Let’s examine each of the inputs to the equation and identify the kinds of uncertainties that apply.

Bit Cost

Bit cost seems simple and absolute, but how do we cater to re-run bits? Should we apply the total cost to the first run and zero cost to subsequent runs, or should we spread the cost evenly between each run, or employ some other method?

Repaired bits introduce a similar complexity. Repair costs for PDC bits can be substantial, up to 40% of the original price. How should this cost be distributed? What about multiple repairs?

There is no simple or correct answer to any of these questions. Good arguments can be made for different approaches. The two important points to remember are:

- Be consistent in your assumptions.

- Clearly state your assumptions.

For any oil & gas well, never believe or use a drilling cost per foot figure that is not accompanied by a full statement of values used and an explanation for these values.

Rig Cost

Rig cost per hour can be as ‘variable’ as bit cost. Should we use the rig rate? That is too low. Do we use rig rate times some nominal multiplier, say two? Do we take the total anticipated well cost and divide it by well duration? Or should we only use the direct drilling costs? Again, there is no correct answer, but you should be consistent and state your assumptions.

Trip Time

Trip time is the next element in the equation. We do not want to use actual trip times from the well – remember that our interest is in projected performance, not history. Trip times may vary with the rig capabilities: we want to use a figure that reasonably reflects the time for tripping on the planned well with the intended rig.

Often a calculated time is used: allowing one thousand feet per hour round trip from the Depth Out is the most common. Sometimes an overhead time of one or two hours is added for Bottom Hole Assembly changes (check types of bottom-hole assembly).

If a wiper trip is an integral part of the operation and is planned, it should be included. Wiper trips that have occurred historically for incidental hole problems such as stuck pipe or lost circulation should be ignored.

Interval Drilled

Remember that we are projecting performance. The ‘Interval Drilled’ should be the interval from the planned well. Errors can occur where the differences in intervals drilled are significant.

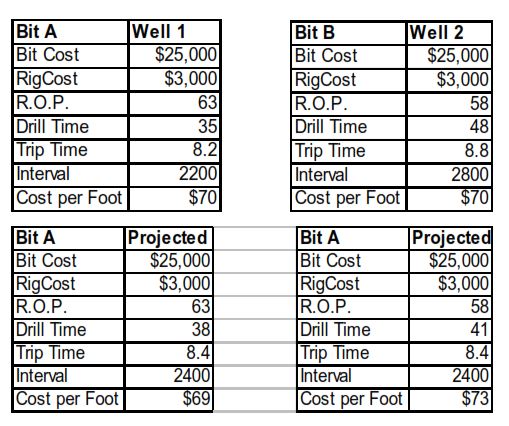

For example, the actual oil well drilling cost per foot for Bits A and B, used on Wells 1 and 2, respectively, is the same. However, Bit B has drilled 600’ (27%) further. This has diluted the cost of the trip and the bit, lowering the cost per foot. If we project the bit performances (ROP) over the interval to be drilled on the planned well, then we see Bit type A is slightly less expensive.

Drilling time & Oil well cost per foot

This is also open to interpretation. Depending upon whether connections were included or excluded, there will be a difference in ROP,

Again, there is no right or wrong figure: we should be consistent and recognize that our choice can alter the outcome. Where performances are close, a slight adjustment in trip time calculation may alter the preferred bit selection.

Check related scientific papers below:

- A statistical solution for cost estimation in oil well drilling

- Drilling Costs Estimation for Hydrocarbon Wells

Does this rig cost include؛ rig mob / demob charges (mob on one well & demob on next well), security charges, several rental equipment & svcs, tubular svcs, casing/ liner running, mud logging, mud engineering, wireline logging, land acquisition, transport svcs……… kindly elaborate.

Thanks

Hmmm